Moody’s Investors Service (“Moody’s”) has today downgraded the Government of Sri Lanka’s foreign currency issuer and senior unsecured ratings to B2 from B1 and changed the outlook to stable from negative.

The decision to downgrade the rating to B2 is driven by Moody’s view that ongoing tightening in external and domestic financing conditions and low reserve adequacy, exacerbated most recently by a political crisis which seems likely to have a lasting impact on policy even if ostensibly resolved quickly, have heightened refinancing risks beyond levels anticipated when the rating agency affirmed the rating at B1 with a negative outlook in July. Moody’s projections include a slower pace of fiscal consolidation than assumed in July to reflect disruption to fiscal policy implementation in a period of political turmoil.

The stable outlook denotes balanced credit risks at the B2 rating level. Moody’s expectation is that, despite the current political crisis, any future government will remain broadly focused on implementing important fiscal, monetary and economic reforms that would strengthen the credit profile over the medium term. However, Moody’s assessment is that the government’s debt refinancing will remain highly vulnerable to sudden shifts in investor sentiment in a period of further tightening in financing conditions and political and policy uncertainty, with limited buffers to face such risk.

Concurrently, Moody’s lowered the local-currency bond and deposit ceilings to Ba2 from Ba1. The foreign-currency bond ceiling was lowered to Ba3 from Ba2 and the foreign currency deposit ceiling was lowered to B3 from B2.

RATINGS RATIONALE

RATIONALE FOR THE RATING DOWNGRADE TO B2

POLITICAL CRISIS EXACERBATES REFINANCING RISK AS FINANCING CONDITIONS TIGHTEN, RESERVE ADEQUACY IS LOW

Sri Lanka’s low foreign exchange reserve coverage of large external debt repayments over the next five years exacerbates its reliance on external bilateral and commercial lenders’ willingness to refinance maturing debt. The risks related to that structural external vulnerability are rising in an environment of tightening financing conditions globally and, most recently, heightened domestic political tensions which threaten to undermine international investors’ confidence and the flow of foreign capital, from private markets and international bilateral lenders, into Sri Lankan financial assets.

The political situation has also resulted in delay to the disbursements planned under the IMF programme. A prolonged pause in the IMF programme, associated to uncertainty about the direction of policy, would likely undermine investors’ confidence, exacerbating the tightening in financing conditions.

Tightening external financial conditions and domestic political instability are resulting in capital outflows and placing increasing pressure on the exchange rate and foreign exchange reserves. The Sri Lankan rupee has depreciated about 13% over the past 12 months to 176.7 per US dollar as of November 16, 2018, of which around 9% occurred in the last three months. In addition, spreads on Sri Lankan bonds over US Treasuries have widened sharply in recent weeks to more than 550 basis points. Combined, these factors are raising the value and cost of external debt.

If prolonged, tightening global financial conditions and domestic political instability could hinder the government’s access to global capital markets, curb foreign direct investment inflows to the country and reduce funding from international lenders. Such conditions would undermine the sovereign’s ability to meet its large external repayment obligations. The government will need to make principal payments on external debt that could be as high as $4 billion per year between 2019 and 2023, in addition to financing part of the budget deficit externally. International sovereign bonds account for a sizeable portion of maturing government debt over this period.

Moody’s projects foreign exchange reserves (excluding gold and SDRs) to remain in a range of $6.5 to $7 billion in the coming years, lower than it forecast in July. As a result, Moody’s estimates that Sri Lanka’s External Vulnerability Indicator (EVI), the ratio of external debt payments due over the next year to foreign exchange reserves, will be about 180% in 2019 and 2020, higher than previously expected and much higher than the median level for B-rated sovereigns.

Parliamentary approval of the Active Liability Management Act in October allows the government to raise up to an additional LKR310 billion (approximately $1.7 billion, or 2% of GDP) over and above the government’s annual borrowing requirements for the purposes of debt management. This gives the government some flexibility to smooth the timing of its debt refinancing operations and avoid a concentration of debt maturities in the future. However, the benefits will be limited in the next few years given the high level and frequency of debt maturing.

Going forward, the government may pursue a range of financing options, including international US dollar bond issuance, yuan and yen-denominated bond issuances, and loans from China (A1 stable), the Middle East or other bilateral and multilateral lenders. These options may somewhat mitigate but are unlikely to materially reduce refinancing risks, as ongoing tightening in financing conditions raise uncertainty around the timing and availability of funding sources.

The government aims to increase its funding from the domestic market, as domestic Treasury bond maturities are lower in coming years. But although funding from the domestic market can reduce exchange rate risk, given that local currency interest rates are much higher than the average cost of total external government debt (including concessional debt), a switch to domestic financing would involve a rise in the overall cost of debt from already elevated levels.

VOLATILE DOMESTIC POLITICAL CONDITIONS UNDERMINE INSTITUTIONAL STRENGTH

A steady and credible implementation of planned fiscal and economic reforms would improve Sri Lanka’s ability to sustain investor confidence through the upcoming period of large debt maturities. However, the likelihood of the government pursing its reform agenda on the previously planned schedule has fallen following recent political events that have interrupted the reform momentum. Moody’s does not expect the current political crisis to be fully resolved rapidly, and the crisis is in any event likely to leave its mark on the pace and content of the reform programme. Even if past episodes of political disruption have not changed the broad direction of reforms in Sri Lanka, delays in the pace of reform will at a minimum limit the government’s ability to respond to changing market conditions.

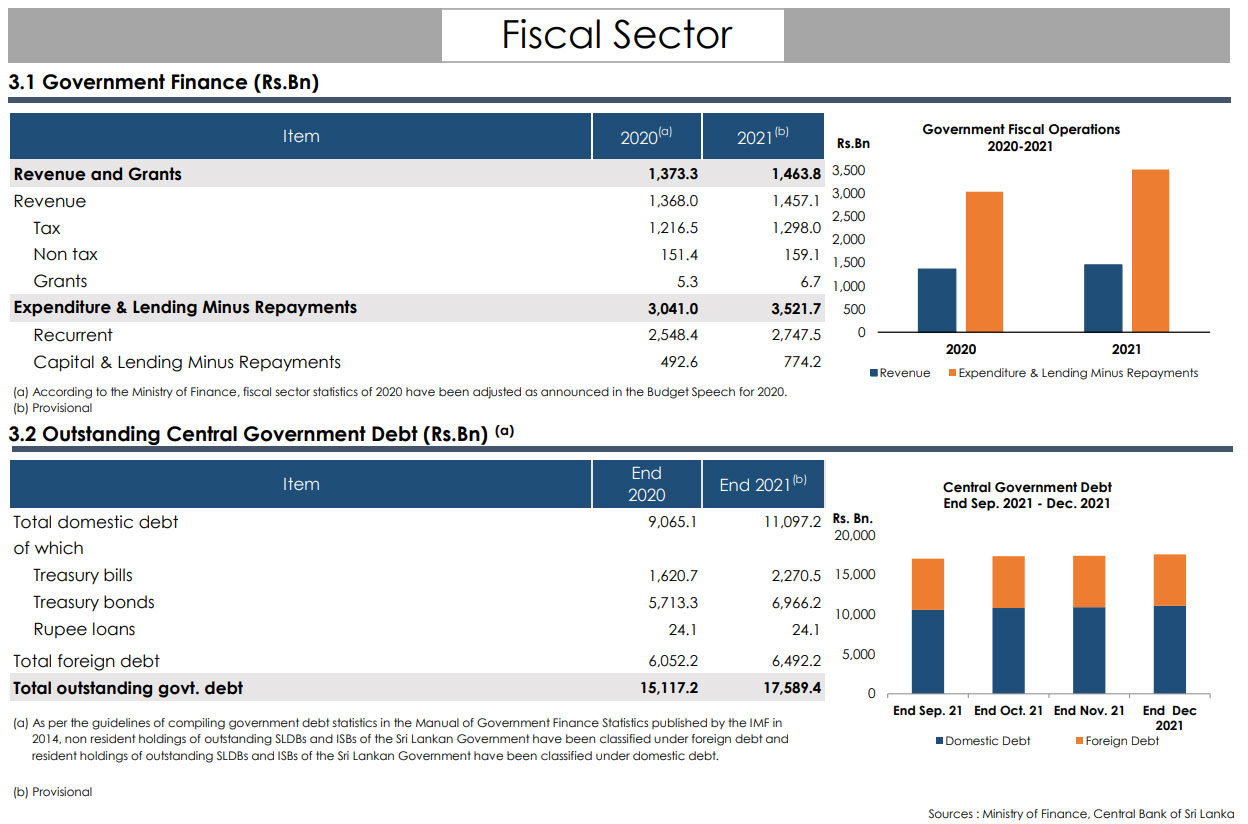

SLOWER FISCAL CONSOLIDATION TO KEEP GOVERNMENT DEBT HIGHER FOR LONGER

Sri Lanka’s large government debt burden and weak debt affordability — along with sizeable external and foreign currency borrowing needs, lower capital inflows and higher financing costs — weigh on Sri Lanka’s already very low fiscal strength and broader credit profile.

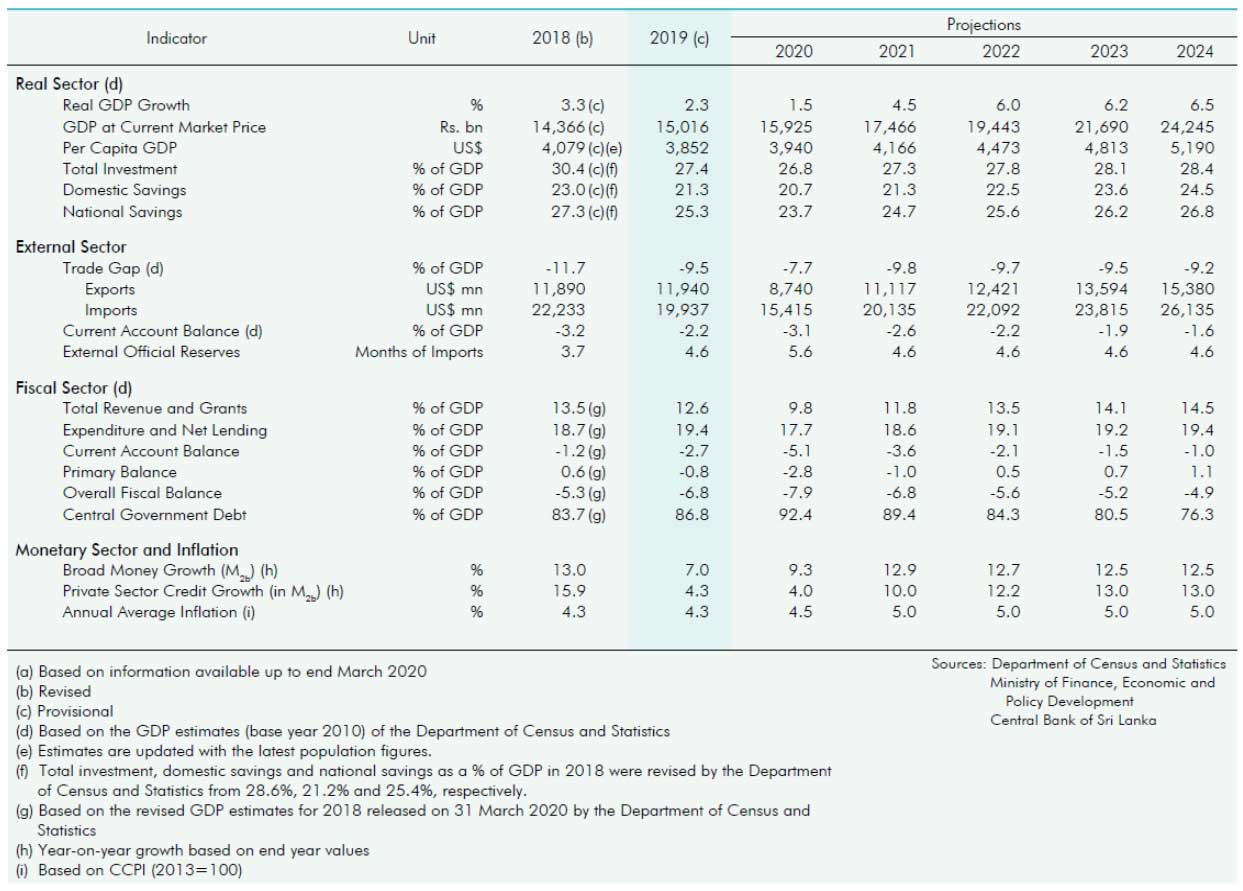

In the face of continued political strife and disruption to fiscal and economic policymaking, fiscal consolidation efforts are likely to resume only slowly. Moody’s expects fiscal deficits to gradually narrow below 5% of GDP in the coming years and the government’s debt burden to continue to decline. However, government debt will remain above 75% of GDP in 2020, from about 77% of GDP in 2017, higher than Moody’s previously expected and higher than many B-rated sovereigns. Even that progress will rely heavily on the successful implementation of durable revenue reforms and expenditure restraint, the risks associated with which have risen in recent weeks.

As a result, Moody’s expects government gross borrowing requirements, incorporating projections on fiscal deficits and maturing government debt repayments, to reach about 19% of GDP in 2018. Although Moody’s expects them to fall to around 15% by 2020, that remains a high level — and higher than at the time of July’s affirmation — particularly given the low coverage of reserves and consequently the high and rising EVI.

In the meantime, interest payments will continue to absorb about 40% of government revenue, much higher than most B-rated sovereigns because of Sri Lanka’s high debt burden and significant borrowing requirements, as well as its low, albeit gradually rising, revenue base.

RATIONALE FOR THE STABLE OUTLOOK

The stable outlook denotes balanced risks at the B2 rating level.

Against the backdrop of ongoing political turmoil, there may be changes or delays to policies that could result in a slower pace of fiscal consolidation in the short term. However, Moody’s expects the broad direction of policy will remain focused on gradually narrowing fiscal deficits and lowering government debt, independent of political shocks. The government had planned further reforms to broaden and deepen its revenue base and pursue binding fiscal rules, including implementing a medium-term debt strategy and establishing a debt management agency. Although these measures are reflected in Moody’s fiscal projections, their effectiveness in raising revenue and maintaining a prudent fiscal stance could be higher than currently assumed.

Over the medium term, planned changes to Sri Lanka’s Monetary Law Act should help the central bank anchor inflation expectations and ensure monetary policy independence from fiscal developments. A shift toward market-oriented policy frameworks — including inflation-targeting and floating exchange rate policies — could increase the effectiveness of Sri Lanka’s monetary policy by helping to stabilise the cost of debt at lower levels than in the past and bolster fiscal flexibility.

Moreover, planned efforts to develop and promote exports and foreign direct investment, including through the streamlining of tax laws and foreign investment applications and the ongoing removal of para-tariffs, could bolster GDP growth and foreign exchange reserves to a greater extent than Moody’s currently projects, helping restore foreign reserve adequacy.

This is balanced against Moody’s assessment that Sri Lanka’s vulnerability to tightening in financing conditions will remain high and will rise — as reflected in the EVI — over the period of large debt maturities. A sharp rise in refinancing costs would further erode debt affordability and weigh on already very low fiscal strength and low reserve adequacy.

WHAT COULD CHANGE THE RATING UP

Moody’s would consider upgrading the rating should it conclude that Sri Lanka’s vulnerability to refinancing risk, which anchors the rating at B2, is likely to diminish. In particular, a faster and more sustained buildup in non-debt creating foreign exchange inflows, which could stem from policy measures which improve investor confidence and enhance FDI inflows, would bolster reserve adequacy over time and lower government liquidity risks and external vulnerability risks.

The implementation of further reforms that significantly lower fiscal deficits and government debt and enhance debt affordability could also prompt Moody’s to upgrade the rating.

WHAT COULD CHANGE THE RATING DOWN

Given repeated large debt maturities over 2019-2023 and Sri Lanka’s already high exposure to refinancing risk, Moody’s would consider downgrading the rating if external and domestic financing conditions were to deteriorate further than currently expected. In particular, a larger drain on foreign exchange reserves would increase the risk of lower capital inflows and sharply raise refinancing costs. This would contribute to repayment stresses that would be more consistent with a B3 rating.

Moody’s would also consider downgrading the rating if the government were to reverse recent reforms or to halt implementation of future reforms to address fiscal and external vulnerabilities and bolster GDP growth potential. That would lead to much wider fiscal deficits, larger gross borrowing requirements and higher government debt than Moody’s currently projects, weighing on already very low fiscal strength and further heightening liquidity risks.

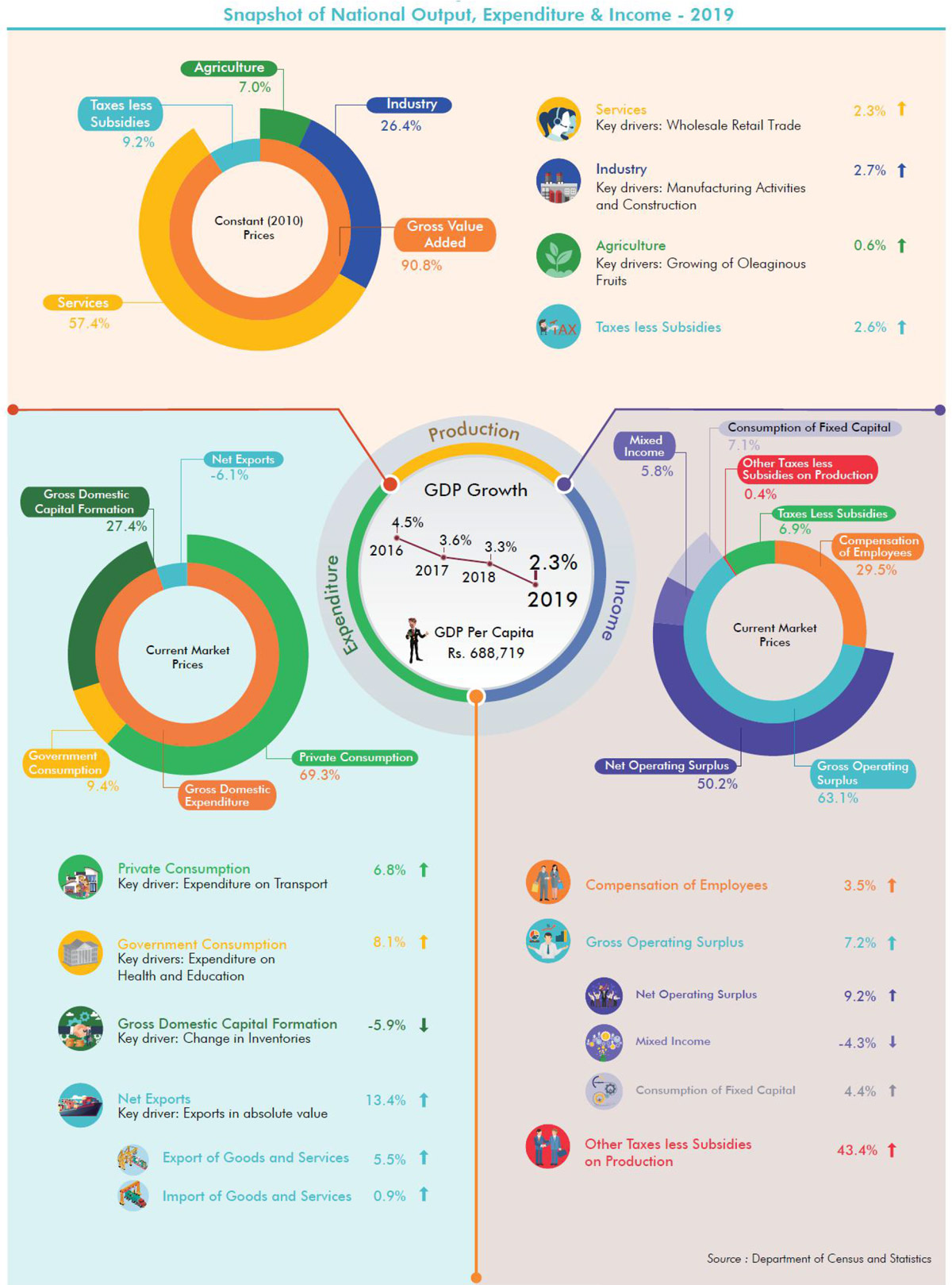

GDP per capita (PPP basis, US$): 12,863 (2017 Actual) (also known as Per Capita Income)

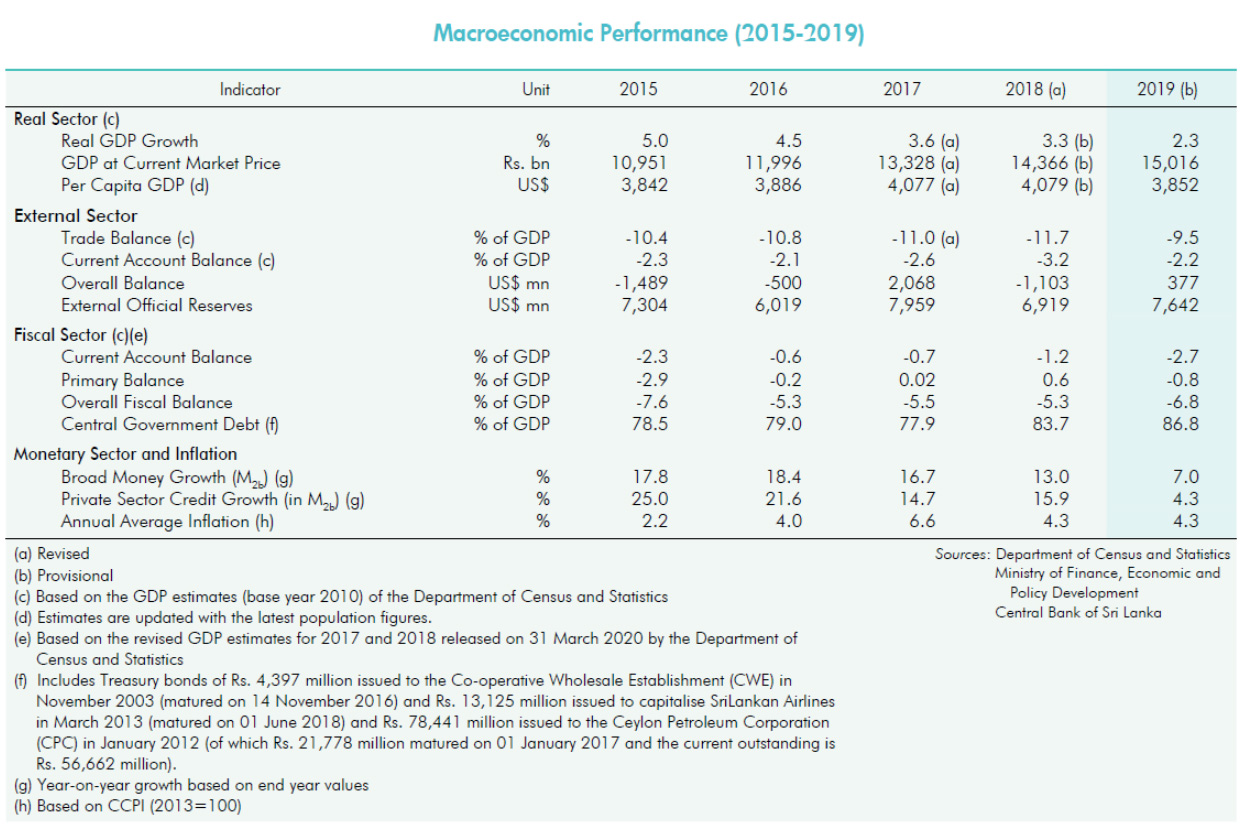

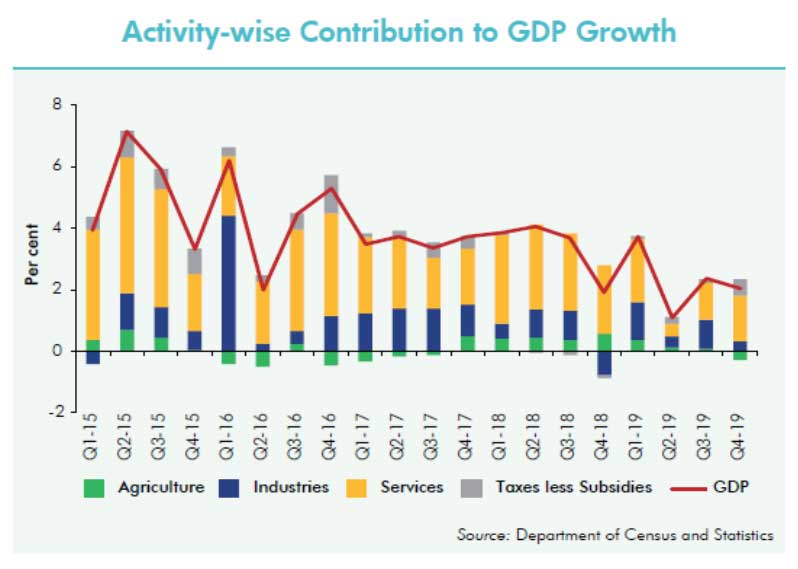

Real GDP growth (% change): 3.3% (2017 Actual) (also known as GDP Growth)

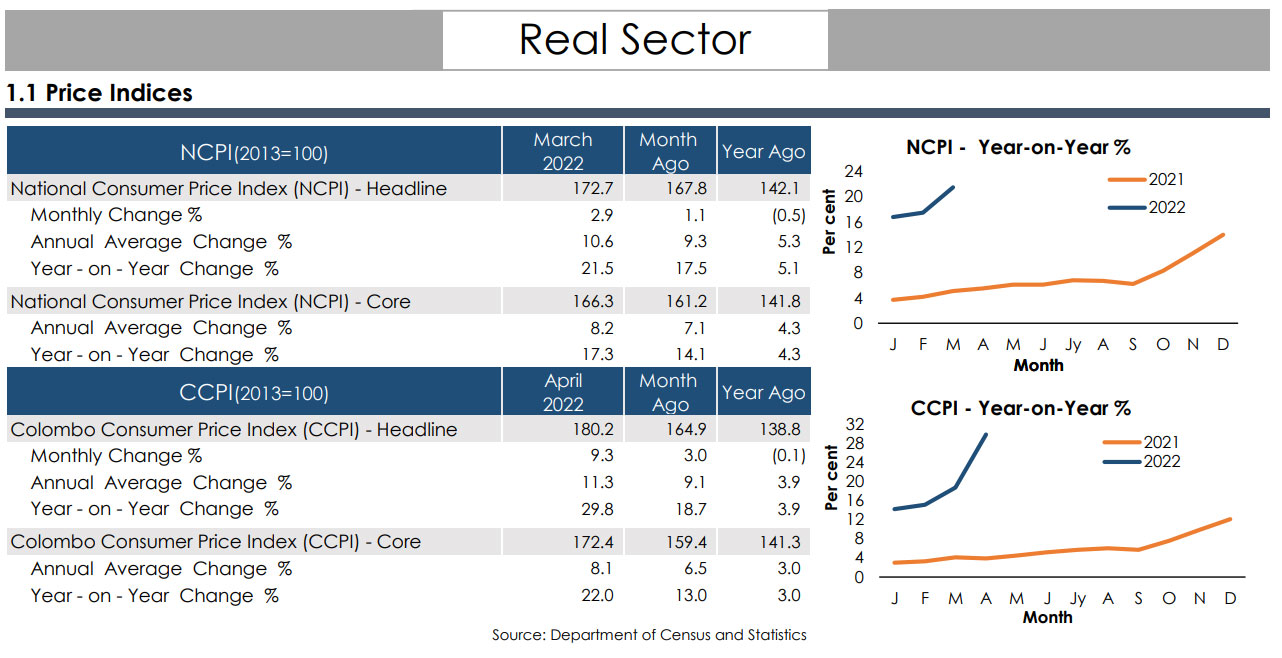

Inflation Rate (National CPI, 2013=100, % change Dec/Dec): 7.3% (2017 Actual)

Gen. Gov. Financial Balance/GDP: -5.5% (2017 Actual) (also known as Fiscal Balance)

Current Account Balance/GDP: -2.6% (2017 Actual) (also known as External Balance)

External debt/GDP: 59.4% (2017 Actual)

Level of economic development: Moderate level of economic resilience

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 15 November 2018, a rating committee was called to discuss the rating of Sri Lanka, Government of. The main points raised during the discussion were: The issuer’s economic fundamentals, including its economic strength, have not materially changed. The issuer’s institutional strength/framework, have materially decreased. The issuer’s fiscal or financial strength, including its debt profile, has not materially changed. The issuer has become increasingly susceptible to event risks.

The principal methodology used in these ratings was Sovereign Bond Ratings published in December 2016. Please see the Rating Methodologies page on www.moodys.com for a copy of this methodology.

The weighting of all rating factors is described in the methodology used in this credit rating action, if applicable.

REGULATORY DISCLOSURES

For ratings issued on a program, series or category/class of debt, this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or note of the same series or category/class of debt or pursuant to a program for which the ratings are derived exclusively from existing ratings in accordance with Moody’s rating practices. For ratings issued on a support provider, this announcement provides certain regulatory disclosures in relation to the credit rating action on the support provider and in relation to each particular credit rating action for securities that derive their credit ratings from the support provider’s credit rating. For provisional ratings, this announcement provides certain regulatory disclosures in relation to the provisional rating assigned, and in relation to a definitive rating that may be assigned subsequent to the final issuance of the debt, in each case where the transaction structure and terms have not changed prior to the assignment of the definitive rating in a manner that would have affected the rating. For further information please see the ratings tab on the issuer/entity page for the respective issuer on www.moodys.com.

For any affected securities or rated entities receiving direct credit support from the primary entity(ies) of this credit rating action, and whose ratings may change as a result of this credit rating action, the associated regulatory disclosures will be those of the guarantor entity. Exceptions to this approach exist for the following disclosures, if applicable to jurisdiction: Ancillary Services, Disclosure to rated entity, Disclosure from rated entity.

Regulatory disclosures contained in this press release apply to the credit rating and, if applicable, the related rating outlook or rating review.

Source: https://www.moodys.com/