Eight Big Tech platforms (Alibaba, Alphabet, Amazon, Baidu, Meta, Microsoft, Netflix, and Tencent) are on course to account for 10.0% of all worldwide ad investment by 2030

WARC Global Advertising Trends: Big Tech’s growing share of the post-COVID ad economy

5 May 2022 – A new WARC analysis of advertising investment by eight major digital platforms has underlined the importance of ‘Big Tech’ to the health of the global ad economy. These findings are published today by WARC, the international marketing intelligence service, as part of its WARC Media suite.

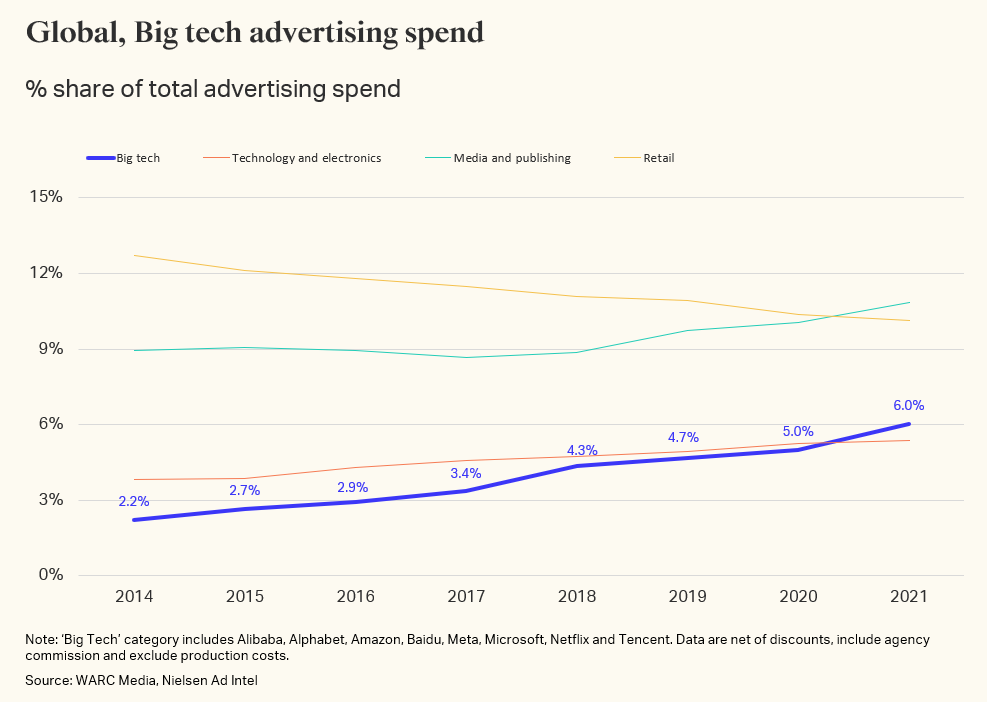

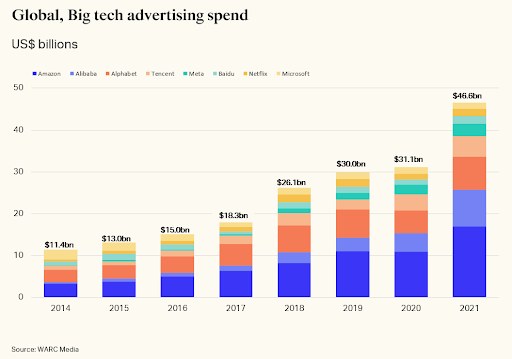

Advertising expenditure by Alibaba, Alphabet, Amazon, Baidu, Meta, Microsoft, Netflix, and Tencent in 2021 totaled $46.6bn (+49.4% year-on-year), accounting for 6.0% of all ad investment globally. On the current trajectory, Big Tech’s share of global ad spend will surpass 10.0% by 2030.

Big Tech’s spending on advertising is also growing faster (+49.4%) than categories such as media and publishing (+34%), technology and electronics (+26%), and retail (+21%). Analysis by WARC found that Big Tech contributed more than a tenth (10.4%) of all global ad spend growth in 2021.

Amazon becomes the world’s biggest-spending advertiser

In 2009, Amazon founder Jeff Bezos infamously asserted that “advertising is the price you

pay for having an unremarkable product or service.” Fast-forward to 2021 and Amazon invested $16.9bn in ads (+55.0% year-on-year), the most ever spent by a single company within a 12-month period.

However, Amazon’s expenditure model appears to be self-funding: investment in advertising helps Amazon to draw shoppers to its e-commerce platform, which in turn increases the revenue it gains from retail media ads – as well as ad spend on products like Twitch and Freevee.

The second-largest advertiser within Big Tech is Alibaba, which invested $8.8bn (+84.4%) in 2021. Fuelled by China’s flourishing e-commerce market, Alibaba has grown its share of total spend in the Big Tech category from 2.9% in 2014 to 19% in 2021 – exceeding Google-owner Alphabet in total ad investment ($7.9bn, +47.0%) for the first time.

Among the companies analysed by WARC, Microsoft shows the lowest commitment to advertising. It invested $1.5bn in 2021, a sum that has remained stable since 2016. However, this may change in light of the prospective acquisition of gaming company Activision Blizzard and Microsoft’s growing ambitions in the metaverse space.

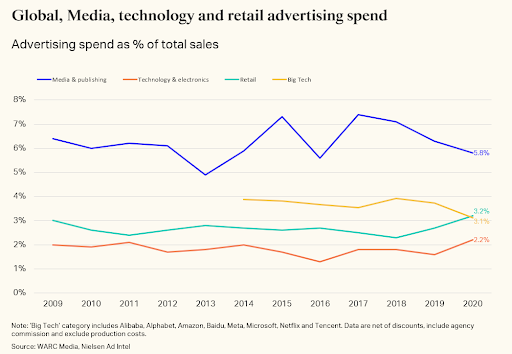

Big Tech’s ad spend as a percentage of total sales declines

While Big Tech companies are investing vast sums on advertising in absolute terms, these platforms are also growing revenues at a remarkable rate.

In many cases, Big Tech brands are investing a lower percentage of total sales in advertising. These businesses do not feel bound by rules to maintain levels of ad spend relative to total sales, as one might find in categories such as CPG or automotive.

The notable exception is Facebook-owner Meta, which has accelerated its ad investment.

Meta’s ad spend as a percentage of sales has grown from a mere 0.8% in 2017 to 2.5% in 2021.

Alex Brownsell, Head of Content, WARC Media, and author of the report, says: “Big Tech businesses have come a long way from being ad investment sceptics, to ranking among the biggest-spending advertisers in the world. As their dominance of the mobile-first digital commerce marketplace increases, so too their share of total global ad spend is likely to grow.

“It underscores that, while digitally-native brands can succeed in the short-term without the support of ad spend, long-term success often depends upon a willingness to invest in performance-enhancing and brand-building advertising.”

Latest Market Intel

Americas

- Latin America records the strongest decline in Netflix subscribers

- 59% of urban Americans choose shorter travel trips in 2022

- One in four Mexicans have used a buy now pay later service in Q1 2022

Asia Pacific

- China and South Korea lead e-commerce sales

- 80% of online urban Indians follow influencers on social

- Australian linear TV audiences show strong growth in 2021

Europe, Middle East and Africa

- One-third of gaming revenue in EMEA is from advertising

- Polish consumers show the highest levels of concern about inflation in EMEA

- A third of chain retail sales in the UK were online in 2021

Global Ad Trends, a bi-monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments, is part of WARC Media, an enhanced dedicated independent and objective one-stop online subscription service which rigorously harmonises, aggregates, verifies and evaluates data from over 100 reputable source, empowering media decision makers to build strategies with precision.