- The group records a steady top-line of LKR 4,393 Mn and Gross Margin of 62% in FY21/22

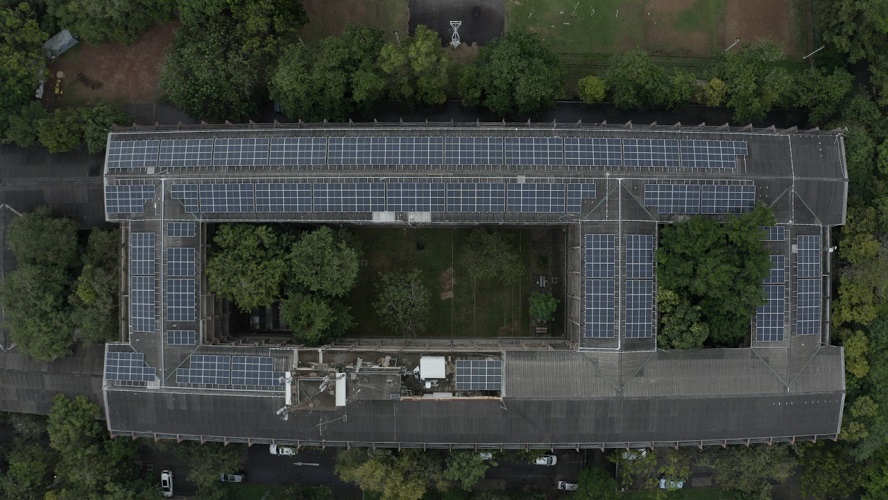

Colombo, Sri Lanka, 31st May 2022 – WindForce PLC is recognized as the largest Independent Power Producer (IPP) of renewable energy in Sri Lanka. Pioneering wind power generation locally, WindForce will hold over 245MW in their portfolio at the end of the current financial year, and was the first Sri Lankan company to set up solar power plants in Pakistan, Uganda, and Ukraine.

Renewable energy generation is known to be highly seasonal with Sri Lanka’s wind patterns varying throughout the course of the year. Therefore, as WindForce’s power generation is predominantly based on wind power, it is prudent to appraise the company’s financial performance in terms of gross profitability on an annual basis as opposed to a quarterly appraisal.

As the largest IPP, WindForce has shown tremendous resilience amidst turbulent times maintaining stability in both top-line and gross profitability over financial years 2021 & 2022. In FY21/22, the company recorded a group revenue of LKR 4,393Mn contributing to a 2% YoY growth despite significant economic headwinds, and a gross profitability of LKR 2,724Mn reflecting a gross profit margin of 62%.

The top-line achievement in FY21/22 was amidst several operational disruptions such as a breakdown at the CEB’s Norochcholai Wind Collector Substation which was subsequently rectified in September 2021, as well as decreased operational capacity in WindForce’s Joule and Beta power plants due to blade damages caused by lightning. With repairs being made to the damaged turbine blades, the company expects to run at full capacity in the current financial year.

Further, as with most companies, key policy changes implemented by authorities such as the sudden floatation of the Sri Lankan Rupee in early March following a hard peg throughout, led to the company absorbing a significant exchange loss of LKR 296Mn on foreign currency loans in a single quarter, i.e. Q4 of FY21/22. However, it is important to note that all overseas project revenue is entirely foreign currency denominated, and all foreign currency debt is backed by foreign currency assets. In dollar terms, total FC assets stood at twice the total FC debt as of 31st March 2022, where FC assets are held at cost, and loans revalued quarterly.

It is noteworthy that WindForce has continued in its efforts to successfully venture into new projects in FY22/23 to support the company’s medium-long term growth. At the end of 2022, WindForce is expected to add 25MW of solar and wind power to the local grid, where operational earnings are expected to flow from the second quarter of FY 22/23 onwards.

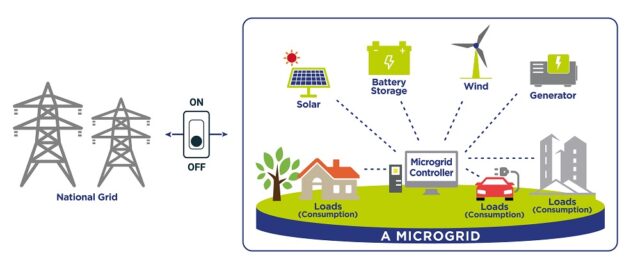

On the international front, WindForce is looking to expand the Tororo solar plant in Uganda by 30MW and are awaiting the generation license approval from the Regulator in Uganda. Discussions are also currently underway with the utility in Senegal regarding the 30MW solar + 7.5MW battery energy storage system, to set a beneficial tariff rate.

Locally, the sector’s economic contribution is demanding change in overall industry dynamics, with a greater emphasis on the shift to renewable energy, and upward revisions in CEB tariff rates. As an IPP with a strong local presence and a foreign footprint, WindForce is well-positioned to capitalize on opportunities both locally and globally.