– The JB Vantage Money Market Fund has grown over the past 10 years with an annualised 11.11% p.a. return and 300% annualised growth in assets under management at 30th June 2021

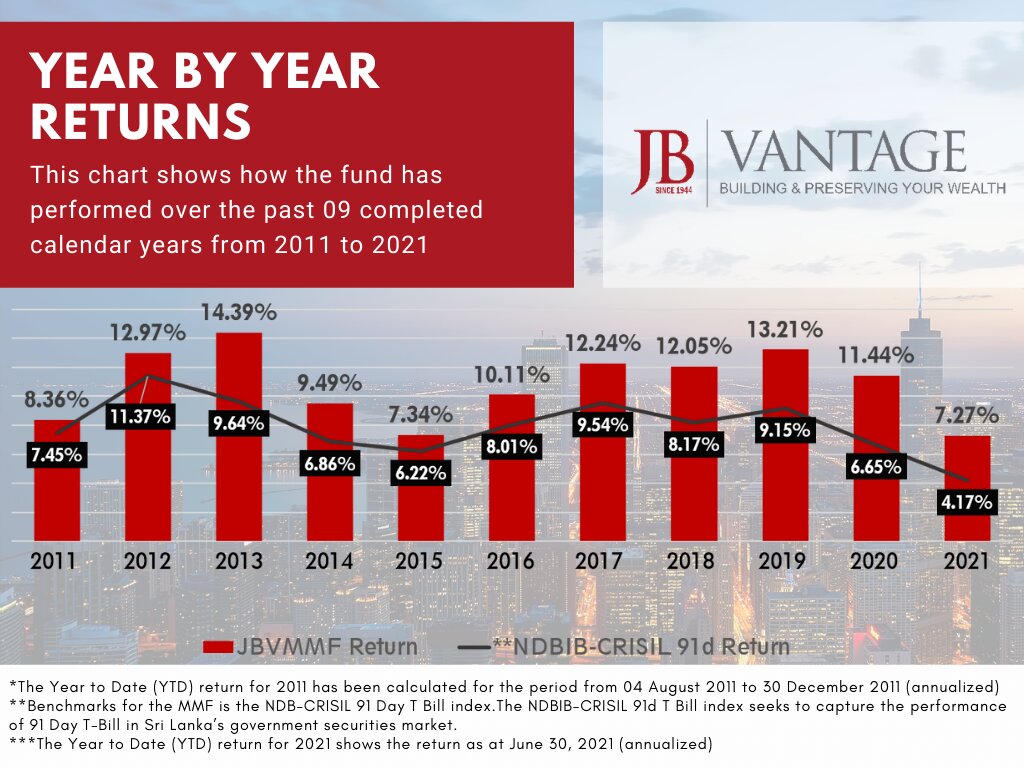

– The Fund has outperformed the industry benchmark (NDBIB-CRISIL 91 day t-bill) index over the past 10 years; with an annualised 7.27% p.a. return for the first six months of 2021.

The JB Vantage Money Market Fund (MMF) celebrates its tenth year; launched on August 04th, 2011, the Fund started with Assets Under Management (AUM) of LKR 730 million (December 2011) and has grown to a value of over LKR 22.22 billion (30th June 2021). The Fund has celebrated many achievements and accolades; such as compliance with GIPS® and Asset Manager Code, a SL A+ (mfs) rating from ICRA and it garnered four Best Unit Trust awards at the CFA Sri Lanka Capital Market Awards.

Money Market Funds are low-volatility investment opportunities that allow both an attractive return on your money and a high degree of liquidity. That means you can easily and quickly move cash in and out of a money market fund without penalties. JB Vantage has a proven track record of providing clients with higher returns within the Money Market Unit Trust category. With readily available cash payout to investors within two working days of receiving a redemption request ensuring a positive client experiences through investment performance and personal attention to client relationships.

Christine Dias Bandaranaike CFA, CEO, JB Financial, speaking on the occasion of the anniversary said, “JB Vantage Money Market Fund has over the past ten years maintained a strong track record, with outperformance and asset growth in a competitive fixed income environment. We are committed to delivering funds to our client-base that can improve their investment outcomes. A Money Market Fund provides access to investments otherwise only available to the most high net-worth individuals. This means investors can benefit from sophisticated products such as commercial papers and trust certificates which carry superior risk adjusted yields. Our Fund’s strong performance was aided by the active management approach and dynamic portfolio positioning. ”

She further added, “Our team is results-oriented and we’ve delivered in some of the most challenging markets on record with our Net Asset Value (NAV) not dropping in the past ten years. We have shown an annualised Fund return of 11.11% p.a. from inception to 30th June 2021; our primary focus on investing excellence expands well beyond the competitive results.”

The JB Vantage Money Market Fund is a great investment opportunity for short term investors looking for competitive rates of interest and minimum capital risk. It is also a great investment for those that are uncertain of the time they could dedicate to investing in their personal finances and for companies with working capital management, to earn interest while waiting to pay out a large outflow. The fund managers will invest pooled investor capital into money market securities that include bank and finance company fixed deposits, high-grade commercial papers, and short-term debentures. The Fund is licensed by the Securities and Exchange Commission of Sri Lanka (SEC) and Deutsche Bank AG Colombo branch acts as its trustee.

For further information on the JB Vantage Money Market Fund Unit Trust contact on +94 112490900 or visit their website on www.jbvantage.lk

Disclaimer: past performance is not indicative of future performance.