An umbrella company is sometimes used by professionals who work in other countries in conjunction with other parties. They solve many legal complications such as how to tax a person who is not a direct employee of a foreign client or recruitment agency. While these companies have sprouted up in record time in the UK, they are also being used to launch into other emerging markets.

Umbrella Company ?

An umbrella company employs professionals who perform work on temporary contracts, usually through a recruitment agency. Recruitment agencies typically prefer to issue contracts to limited companies because their liability is reduced. The umbrella company is responsible for tax compliance and processing payroll.

How Does an Umbrella Firm Work?

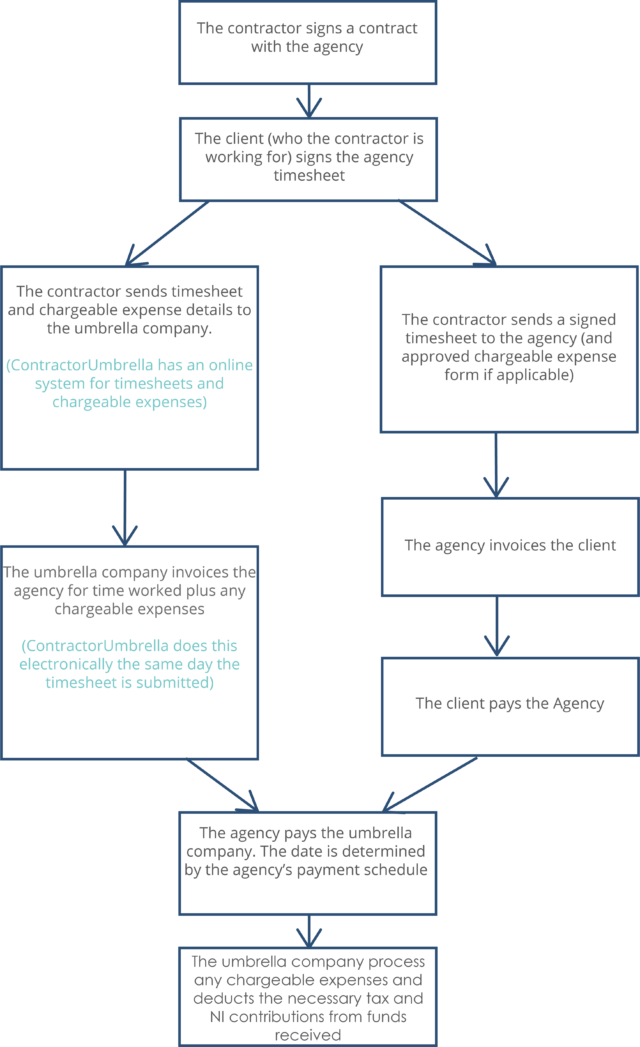

The specific umbrella structure will be based on the contracts between the relevant parties. However, the process may generally follow the outline below;

- The umbrella acts as the employer of record for employees you later seek to engage.

- The umbrella enters into a business-to-business (B2B) relationship with the recruitment agency.

- The professional signs a contract of employment directly with the umbrella company.

- The professional works for the foreign business.

- A manager who is authorized to do so monitors daily activity on the job site and signs the professional’s timesheet. The manager signs the timesheet to confirm the days and hours worked.

- The timesheet may also include expenses the professional incurred.

- The professional submits the timesheet to the recruitment agency and the umbrella.

- The umbrella firm prepares an invoice for the professional’s payment to the recruitment agency for the hours worked and any reimbursable expenses.

- The recruitment agency bills the end-client.

- The end-client pays the recruitment agency.

- The recruitment agency remits payment to the umbrella firm.

- The umbrella company processes payroll and makes the proper allocations for the professional’s salary and reimbursable expenses, deductions for taxes, agreed-upon deductions and the agreed-upon umbrella fee.

- The process continues for the next pay period.

Umbrella Companies Structure

An umbrella organization bridges relationships between the client, recruitment agency, professional and the umbrella company. Umbrella companies employ professionals through the use of contracts of employment. These contracts specify the requirements of each party. Typically, the umbrella company is tasked with the responsibility of issuing invoices for the contractor’s work.

Because of the use of umbrella organizations, the other companies and the contractor can retain their current entity status without having to establish a foreign entity. Because the contractor is not paying their own tax, they do not have to set up their own company.

Because of the use of umbrella organizations, the other companies and the contractor can retain their current entity status without having to establish a foreign entity. Because the contractor is not paying their own tax, they do not have to set up their own company.

The umbrella is responsible for paying the professional, but the professional is required to submit his or her timesheet also to the recruitment agency. After receiving payment from the recruitment agency, the umbrella firm processes payroll, handling all compliance requirements and processing deductions. The umbrella pays the professional. Some umbrella companies are structured in a way that professionals establish their own entity as a limited company. This usually translates into a lower declared salary with various expenses that may be used to reduce taxable income. Any legitimate business expenses the professional incurs can potentially be claimed.

Umbrella Company Services

The services an umbrella offers will be spelled out in its contract with the professional and its business to business contract with the recruitment agency. However, umbrella firms often provide invoicing services and handle tax, contributions and deductions. This is their primary function. The umbrella company provides a payroll service to its employees, processes timesheets and invoices, processes payroll and pays employees their wages and any reimbursable expenses. Some umbrella companies act as a billing agent between the client and the recruitment agency. Because the professional is the employee of the umbrella organization, the professional is usually entitled to the same benefits as other employees, such as sick pay, holiday pay and severance pay. The umbrella company is responsible for administering these benefits.

Benefits of Umbrella Companies

Working with an umbrella company can provide many benefits to foreign businesses. The umbrella company is the direct employer of record of the contractor, so the foreign company does not have to worry about compliance matters like immigration or tax laws. The umbrella firm handles the payment to the contractor and can arrange to pay in a currency that works for the foreign business while the umbrella organization pays in the local currency. This option appeals to contractors because they can claim work-related expenses free of tax, so using an umbrella company can help the foreign business attract more talent. The process is often very straight-forward with the contractor only needing to submit their timesheet and other required documentation to the umbrella company, which then pays the contractor. This streamlines the administrative process and reduces costs.

Learn More about Umbrella Companies

Sponsored Content: Umbrella Employment Service Providers in Sri Lanka : With over five decades of collective experience in HR services and Payroll and Resource outsourcing in Sri Lanka, Exroasia brings you a one stop HR, Payroll and GEO/PEO services to your doorstep. Our experience in the industry along with our seamless extension to your business will allow you to focus on growing bigger and better. Exroasia team consists of seasoned Professionals in HR and Payroll services. They invest heavily in training our Professionals to keep up with International standards and changing industry trends. Visit Exroasia Website, a company specialized for Umbrella Employment Services.